Navigation

Install the NWFA app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More Options

You are using an outdated browser

The browser you are using is likely incompatible with our website. We recommend upgrading your current browser or installing an alternative.

JavaScript is disabled

Our website requires JavaScript to function properly. For a better experience, please enable JavaScript in your browser settings before proceeding.

-

Join the #1 community for gun owners of the Northwest

We believe the 2nd Amendment is best defended through grass-roots organization, education, and advocacy centered around individual gun owners. It is our mission to encourage, organize, and support these efforts throughout Oregon, Washington, Idaho, Montana, and Wyoming.Free Membership Benefits

- Fewer banner ads

- Buy, sell, and trade in our classified section

- Discuss firearms and all aspects of firearm ownership

- Join others in organizing against anti-gun legislation

- Find nearby gun shops, ranges, training, and other resources

- Discover free outdoor shooting areas

- Stay up to date on firearm-related events

- Share photos and video with other members

- ...and much more!

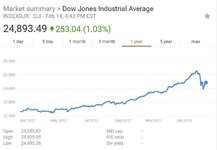

The January 2018 stock market - easy come, easy go.

- Thread Starter The Heretic

- Start date

-

- Tags

- easy stock stock market

Well got some AMAT calls today with earnings tomorrow after close. Hope for a beat and great guidance but looks good. Also took a bigger position in SVXY ([email protected]) with vix looking to drop more look good also.

Still curious if @TriggerDude15 has an update to the prediction of a market collapse. Honestly curious as he seemed to have some inside info the rest of us didn't have. I know the other thread is closed, but this one is still available for a response.

Still curious if @TriggerDude15 has an update to the prediction of a market collapse. Honestly curious as he seemed to have some inside info the rest of us didn't have. I know the other thread is closed, but this one is still available for a response.

Does it matter at this point anyway? It didn't collapse, so even if there was some inside info, it was wrong.

Does it matter at this point anyway? It didn't collapse, so even if there was some inside info, it was wrong.

What I'd really like to know is what info/sources to avoid in the future. A lot of people make predictions, including supposed experts. I like to know who not to listen to.

What I'd really like to know is what info/sources to avoid in the future. A lot of people make predictions, including supposed experts. I like to know who not to listen to.

Could be there was no source at all.

Could be there was no source at all.

Granted, that could certainly be the case.

- Messages

- 4,070

- Reactions

- 9,371

What I'd really like to know is what info/sources to avoid in the future. A lot of people make predictions, including supposed experts. I like to know who not to listen to.

You strike me as a pretty smart guy in your investing and I don't think you need to listen to anybody in particular to make good decisions. I read a lot, I listen to the talking heads, I look at what they have done in the past, and I talk with a couple of friends who are good investors. One a bank vice president and another has about 6 million in bonds mostly now, since growth is not needed at this point.

After 30 years in the construction / real estate business, and a pretty hard core investor over the last 8 years, liquidated the construction business, bankruptcy, I have it pretty well figured out. I have the majority of our funds with EJ brokerage and they have done quite well. I certainly do not listen to random people spouting off on message boards and put any stock in it or make any financial moves based upon that bullsh*t. None of the soothsayers are worth listening to.

Staff Member

- Messages

- 9,500

- Reactions

- 21,483

What I'd really like to know is what info/sources to avoid in the future. A lot of people make predictions, including supposed experts. I like to know who not to listen to.

Ooh that's a super tough call.

Read a bunch, listen a bunch, view a bunch, watch a bunch, mend it all together and you still need to make the calls that fit best for you, yours & your situations.

Fortune. Forbes. Maria Bartelomo. Fox Business. CNN money etc etc

The "trick" is to look for trends, but by the time folk are talking about it, it's too late (to make a meaningful short term gain). Long term? Yah absolutely!

It's been a long while since I meddled in stocks. Daytrading mostly with some mid term and some short term. Was as close to gambling as I'd ever like to get (actuality it is in fact gambling, just another nicer term for it). But it was interesting and fun, also very time consuming. Had the time then, and expendable income to do so.

Now? 401's and the like and mutual funds exclusively and we do not give it another thought. The market will go up, the market will go down. Happens. We just don't have the time to manage, nor the portfolio to have a wealth manager. It is what it is, and we're comfortable with that. May change going forwards, may not.

Folks crying chicken little? More than likely day traders trying to whip up a short etc. Happens & happens a lot on blogs, boards etc.

Folks crying chicken little? More than likely day traders trying to whip up a short etc. Happens & happens a lot on blogs, boards etc.

Yup and big money can and will always move the market or keep it down.

Added 500 more SVXY today @11.82 and going to sell my AMAT in the morning. Looking to add MNKD, LRCX, JPM and possably more SVXY if it shows a buying opportunity. Going to put most of my money back in within the next few trading sessions.

Silver Lifetime

- Messages

- 42,877

- Reactions

- 111,405

- Thread Starter

- #92

Big money is not just billionaires. It is also the millions of small time investors with tens/hundreds of thousands shifting the focus of their portfolios around.Yup and big money can and will always move the market or keep it down.

My IRA is still rebalancing (in total in the past 5 days or so I have moved about $150k from bonds into stocks ) but I am back up to where I was at the end of 2017 and before spring I hope to be back where I was 2 weeks ago.

Silver Lifetime

- Messages

- 2,213

- Reactions

- 9,270

Looks like the inflation report didn't faze the market at all!

Silver Lifetime

- Messages

- 42,877

- Reactions

- 111,405

- Thread Starter

- #94

It did, but not for long and not everybodyLooks like the inflation report didn't phase the market at all!

- Messages

- 1,503

- Reactions

- 6,093

Jeff Saut is a good one for RJ (EJ competitor so I'm biased)

Big money is not just billionaires. It is also the millions of small time investors with tens/hundreds of thousands shifting the focus of their portfolios around.

My IRA is still rebalancing (in total in the past 5 days or so I have moved about $150k from bonds into stocks ) but I am back up to where I was at the end of 2017 and before spring I hope to be back where I was 2 weeks ago.

So who do you think big money is? Its the firms that have YOUR money you invested. You think investors move the market? Its firms and very few people that can move 100+ million in a second to create demand or start a selloff.

I always like to get perspective. A year ago, Feb 15, 2017, the market closed at 20,611. Today it closed at 24,893. At the bottom of this correction, it hit 23,860 - still 3,249 above where it was a year ago. This is why it's important to focus on the long term and view the short term with some perspective.

Silver Lifetime

- Messages

- 42,877

- Reactions

- 111,405

- Thread Starter

- #98

So who do you think big money is? Its the firms that have YOUR money you invested. You think investors move the market? Its firms and very few people that can move 100+ million in a second to create demand or start a selloff.

I think people who have IRAs and 401Ks are the big money. Together, they account for over $12 Trillion dollars in those retirement funds alone. More than twice that when you add in all other retirement funds.

When I put my money into a fund, the fund managers don't just willy nilly move the money around. They have to invest it as the prospectus says they will invest it - so much in shares of certain types of corporation, so much in bonds, etc.

When I moved my assets from bonds to equity heavy funds, I was the one that directed that be done, not Edward Jones, not Mass Mutual - me. You get some significant percentage of 401K/IRA holders directing that their assets be moved in or out of the market and stuff happens.

Trillions of dollars is big money and it is held by people like me and you. The typical equity/growth oriented fund is about 80/20 stock/bonds. The managers of those funds cannot make significant changes in how that money is invested - they are constrained by the profile/goals they advertise. They may have some percentage of a fund held in cash in money market accounts, but compared to stock or bonds, that is usually a small amount compared to when large numbers of owners of the shares move from one profile to another.

You get 10% of people who own 401Ks/IRAs moving completely in/out of the stock market, that is $1.2 Trillion dollars and even if it takes a couple of days, it is still a significant move in the market. Yes - big money.

You miss my point. Yes us little guys have a lot invested in overall market but not many of us actively manage it. Dump it in a mutual fund and let it sit. Look at Vanguard for example 3.5 trillion in assets with 4.5 trillion under management. 100-500 million to cover is pocket change and happens all the time. Thats how stocks get beat down or make runs is the big active market guys. If you invest in a mutual fund (most 401k/ira) big money chooses what stocks are in the fund not you so once again big money calling what happens.

Silver Lifetime

- Messages

- 42,877

- Reactions

- 111,405

- Thread Starter

- #100

You miss my point. Yes us little guys have a lot invested in overall market but not many of us actively manage it. Dump it in a mutual fund and let it sit. Look at Vanguard for example 3.5 trillion in assets with 4.5 trillion under management. 100-500 million to cover is pocket change and happens all the time. Thats how stocks get beat down or make runs is the big active market guys. If you invest in a mutual fund (most 401k/ira) big money chooses what stocks are in the fund not you so once again big money calling what happens.

As I pointed out, they have to stay within the constraints of their portfolio/prospectus. They cannot just go out and buy penny stocks, they have to maintain their ratios and the type of stocks they can buy.

And I am not saying that most people actively manage their 401Ks/IRAs, my example was if just 10% of us "little people" decide to move in or out of the market - it makes 500 million look like chump change. Those funds have no control over that - if 10% of their customers dump them, they cannot do diddly about that. We control when and how much and even if we invest in their portfolios. When I moved back into the market it was a move from bonds to stocks, which is a high level abstraction, not a low level directive to buy this or that stock. Those kinds of moves by a significant number of people using a significant percentage of their assets, is much more significant than what any one fund is able to do.

Look at how many people here said they got out or into the market. That is a sample of the millions of people with assets in 401K/IRAs. Just 1% is a $120 billion. Of the people I know at work (besides myself) who shared with me how they reacted to the correction - 25% jumped back into the market in a significant amount, and had pulled out earlier before the correction.

In short, we have much more ability to make big moves with significant percentages of our investments than any one fund does. We can cash them out (move it into money market or even move it into our checking account), move from stocks to bonds and vice versa and so on. Any one fund cannot make those kinds of moves. When some significant percentage of us make a move in the same direction - that moves the market, not a piddling 100 million dollars, but hundreds of billions to trillions of dollars.

Last Edited:

Share This Discussion

Similar threads

Upcoming Events

New Classified Ads

-

Vintage 1960-1970's 3/4 Weaver Marksman 4X scope

- Started by BlackdogGS

- Replies: 0

-

-

-

Glock 42 With 3 magazines and Kramer pocket holster

- Started by stumpy

- Replies: 0

-

-

Misc. 30-30 WIN and 308 WIN Ammo-Silvertip / Older

- Started by JohnH

- Replies: 3

-

-

-

-

Support Our Community

If our Supporting Vendors don't have what you're looking for, use these links before making a purchase and we will receive a small percentage of the sale