BTW, 10 years at a minimum wage job, accounting for living costs such as rent, utilities and so forth........

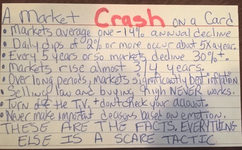

NOT POSSIBLE to invest enough to retire under 30? And be untouched by market changes to boot? WAY MORE to the story here if it's indeed true.

Ah, I'm not gonna waste any more time on this for crying out loud.

On a more realistic note, I bought a new safe today. Liberty Colonial 30.

Paid in cash. And the lights are still on at my house. As will be the ones in the safe. I spared no expense on the extras.

NOT POSSIBLE to invest enough to retire under 30? And be untouched by market changes to boot? WAY MORE to the story here if it's indeed true.

Ah, I'm not gonna waste any more time on this for crying out loud.

On a more realistic note, I bought a new safe today. Liberty Colonial 30.

Paid in cash. And the lights are still on at my house. As will be the ones in the safe. I spared no expense on the extras.