Diamond Supporter

Platinum Lifetime

Platinum Supporter

Gold Lifetime

Silver Lifetime

Bronze Lifetime

- Messages

- 24,617

- Reactions

- 66,456

I was trying to be upbeat...Worse imo.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I was trying to be upbeat...Worse imo.

Musk has sprung the trap! (I hope)Elon Musk has changed his mind and word is that he'll buy Twitter at $54.20 a share. Trading on Twitter has been halted.

Aloha, Mark

PS.......UPDATE.....Trading in Twitter resumed about 15 mins prior to the close of the market. 10-04-22

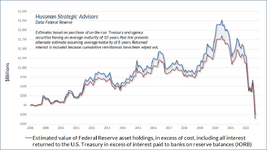

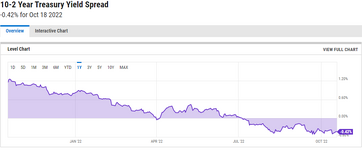

I was looking at the FTD (failed to deliver) report the SEC publishes. One of the stocks had around 250 million shares FTD'd and the stock price has been driven into the ground and is something like $0.004 per share now.Uncommonly low interest rates was all that was keeping free-spending governments afloat. Now that rates are floating upwards toward traditional levels (and probably far beyond) it will force them to take money from other areas or (more likely) just print even more worthless currency. If they choose the latter, it just speeds up the death-spiral of the currency. If they choose to divert other funds, there will be backlash from those dependent on that money. There is no good option.

Although it seems that a collapse should be near, it never surprises me that things just keep going on, like a zombie shambling down the street, dripping corruption as it moves along.

(C)A registered clearing agency may summarily suspend and close the accounts of a participant who (i) has been and is expelled or suspended from any self-regulatory organization, (ii) is in default of any delivery of funds or securities to the clearing agency, or (iii) is in such financial or operating difficulty that the clearing agency determines and so notifies the appropriate regulatory agency for such participant that such suspension and closing of accounts are necessary for the protection of the clearing agency, its participants, creditors, or investors.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/KNLAEWCXYJIEVN34BO3TGIMNSU.jpg)

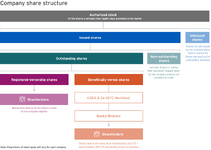

Because TNI has elected to conduct a spin-off in a way that is the antithesis of how normal spin-offs operate, you will be creating an unintended consequence to the financial market that I think you may not have thought of. Regardless of any manner you make the requirement of DTCC Participants to hand over their beneficial holder names – whether via transfer and surrender or providing a list, the impact to trading is significant. Let me explain and give you a for instance. If a DTCC Participant presents to your transfer agent a list for an amount of shares that exceeds their DTCC record date position, what will you do? If for example, the transfer agent goes back to the DTCC Participant and asks where are the remaining shares, the DTCC Participant's likely response will be they are owed to them by another DTCC Participant who has failed to deliver by the record date. Therefore, the client bought the shares for settlement through the record date and is a legitimate and rightful record date holder, but the client's broker-dealer or custodian does not have the shares in their DTCC account because the Seller of the shares have failed to make delivery by record date. Fails are common occurrence in our industry. Another circumstance may be that the DTCC Participant who presents you with the list has previously Loaned shares to another Participant and the Borrower cannot return the shares. In either of these scenarios, it may be very problematic to say who has the shares in their DTCC account because the shares are owed to them by let's say Merrill Lynch, Merrill may be owed the shares by UBS who are owed the shares by JP Morgan and so on and so on. You don't know how far down the rabbit hole goes.

| Mortgage-backed securities4 | 2,698,158 | + 203,405 |

Very little of which is his own, nor which he is committed to pay back personally.World's richest man decides to set $44 billion on fire