Bronze Supporter

- Messages

- 6,745

- Reactions

- 21,501

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

EDJ says that we will still go up next year, but that there will be 2-3 corrections of 5-10%.Same here. Lost $30k in stocks in 3 days last month. Did some quick stop-loss trading and made a couple lucky purchases to offset that. Finally got back yesterday to where I was before that swift kick in the nards. Like I said before. This ride gives me white knuckles.

View attachment 1097927

IMO most look like solid plays. That Micron put is WAY out of the money on a stock that is really gaining momentum in a sector that is pretty strong. Funny as I have a handful of RBLX $100 calls that expire in March. Hope I am right before she is lol.Nancy Pelosi seems to be betting that the market will be taking a dump between now and next fall/winter.

I don't even speak this language. But I don't understand a path out of this without "massive" devaluation of the dollar. Or maybe replace it completely. Which starts to make a ton of sense when viewed from a different perpective, such as that of our financial rivals. I might even look at it as bleeding the American taxpayers dry, we have much to be soaked for, and once that game is over, THEN, make the move.$1.9 trillion reverse repo today. Half the yearly medicare costs being given to the banks with interest every day to cook their books so that they look like they have collateral on the $1 QUADRILLION in derivatives that are over leveraged 300:1

Nothing changed since 2008, no one went to jail. the derivative market has just grown exponentially. Mortgage backed securities, credit backed securities, student loan backed securities, all sliced and diced to act as collateral for this bubble. There are still rating agencies saying Evergande's bonds are B+ despite they haven't paid a single bill months. They cant let them default otherwise it will bring everything down. The world economy is a giant Ponzi scheme. They all know it but are too far involved to get out now otherwise everything will be worthless.

who is going to bail out $1 quadrillion when it fails? That's 12 times the worlds yearly GDP. That's 42,000 times the value of all the gold in the entire world.

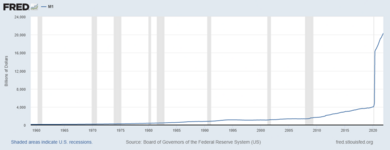

I dont understand most of this as well but I see trends that are just like before 2008 except on a exponentially bigger scale. Like this graph of the M1 which is the "M1 is the money supply of currency in circulation"I don't even speak this language. But I don't understand a path out of this without "massive" devaluation of the dollar. Or maybe replace it completely. Which starts to make a ton of sense when viewed from a different perpective, such as that of our financial rivals. I might even look at it as bleeding the American taxpayers dry, we have much to be soaked for, and once that game is over, THEN, make the move.

Taken from....Now it's one thing to make an investment and lose money, but it's an entirely different thing if my favorite celebrity told me to buy something and I lose money...As a result, Kim Kardashian, Floyd Mayweather and Paul Pierce have been named in a lawsuit, which alleges that they scammed their followers into investing in EthereumMax. This was a crypto that jumped last summer thanks to the celebrity endorsements but fell from about $10.50 all the way down to $1.50. The lawsuit claims that, while regular investors bought EMAX coins, Kardashian, Mayweather and Pierce sold off their assets at a profit....the good ole pump and dump..

www.thestreet.com

www.thestreet.com

Its incredibly depressing to go down that path. to literally see the crime and fraud right out in the open and see nothing getting done about it is terribly frustrating. The SEC knew all about the abuse of EFT's like XRT at least back to 2019 because there are reports and comments right on sec.gov.Dammit Bolus. On one hand, I want to understand this better. On the other, I feel like once I understand, the cards will all fall down.