Bronze Supporter

- Messages

- 16,848

- Reactions

- 27,675

RE : Post #934

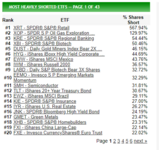

Is anyone still looking to invest in Chinese Developers? I'd argue that even their major corporations and companies are "sketchy".

Standard Disclaimer Applies.

Aloha, Mark

Is anyone still looking to invest in Chinese Developers? I'd argue that even their major corporations and companies are "sketchy".

Standard Disclaimer Applies.

Aloha, Mark