Silver Lifetime

- Messages

- 42,776

- Reactions

- 111,083

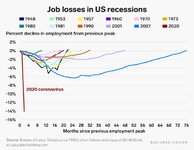

E.U. Is Facing Its Worst Recession Ever. Watch Out, World. (Published 2020)

New forecasts predict a 7.4 percent economic collapse and risks of even worse decline if the reopening triggers a second virus wave.