Silver Lifetime

- Messages

- 42,701

- Reactions

- 110,879

I would just like the week to end with me NOT becoming unexpectedly poorer.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I would just like the week to end with me NOT becoming unexpectedly poorer.

After the dip, I was down about 17% YTDFirst 12 days of August, S&P500 up another 3%+.

Went ahead and aske to roll over $9K (should happen today or tomorrow - which is good theoretically when the market is down?) - a little under the max I can do without a tax liability (complicated by the SS calculations for taxable SS income vs my deductions). Gave myself a little room in case I miscalculated - once taxing SS income kicks in it seems it is not very gradual/linear.After the dip, I was down about 17% YTD

Now I am down about 9% YTD.

I am thinking of doing a rollover from IRA to Roth as my house prep for sale is going very slow due to my back making it hard to do work while recovering from the pain. So I probably won't have tax on the profit this year.

Nothing to see here... Just laying the groundwork for the eventual and complete destruction of the American middle class and the institution of the elite's global NWO in which "...you will own nothing, and you will be happy..." Nothing to see here, sheeple. Go back to your homes. Move along... Move along...I had previously said "nothing has changed since 2008" but in reality what has changed is how the banks will be bailed out when they fall. They can now literally take your pension when the next Lehman Brother's happens.

The rule that was passed:There is a paywall on the trustnodes site, so I didn't see the whole article. It did bring up the question of public sector pensions. Are they fair game now in any bailout. Or perhaps just state and local pensions. Or regular federal employee pensions. But not pensions of current or former politicians, I'm sure!

"[T]he proposed change would allow OCC to seek a readily available liquidity resource that would enable it to, among other things, continue to meet its obligations in a timely fashion and as an alternative to selling Clearing Member collateral under what may be stressed and volatile market conditions."

The IRS leaked some IRA personal information on their main website.

Markets are fighting the Fed | CNN Business

Stocks have experienced a sharp summer rebound, easing fear among investors and boosting hopes the bear market has settled on an early hibernation. But at any moment, strategists warn, the Federal Reserve could deliver a reality check that jolts complacent traders.www.cnn.com

Looks like I am going to have to wait till next year to see any growth in my IRAs.

Wow!The rule that was passed:

Loading…

www.sec.gov

Its all the public pension plans.

and the best part:

Yep, instead of using the bank's collateral, they are going to use the pension plans as a liquidity source for options and futures.

all those pensions people worked for are going to be used by banks for risky bets

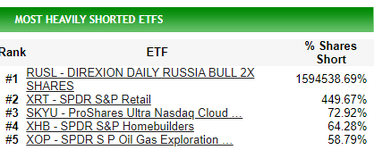

on a completely side note, do you think you'd ever see 1.6 million percent counterfeit shares?

View attachment 1275633

Yeabut as soon as The Inflation Act kicks in we'll be happy because bugs.So far.......the NASDAQ dropped over 4%.

Aloha, Mark

And here I thought 6 months of emergency food/preps stockpile would be sufficient.Fastest rise in food prices in all US history. I wonder at what point does it become cheaper to eat a billionaire than go to McDonalds?

View attachment 1275964