Navigation

Install the NWFA app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More Options

You are using an outdated browser

The browser you are using is likely incompatible with our website. We recommend upgrading your current browser or installing an alternative.

JavaScript is disabled

Our website requires JavaScript to function properly. For a better experience, please enable JavaScript in your browser settings before proceeding.

-

Join the #1 community for gun owners of the Northwest

We believe the 2nd Amendment is best defended through grass-roots organization, education, and advocacy centered around individual gun owners. It is our mission to encourage, organize, and support these efforts throughout Oregon, Washington, Idaho, Montana, and Wyoming.Free Membership Benefits

- Fewer banner ads

- Buy, sell, and trade in our classified section

- Discuss firearms and all aspects of firearm ownership

- Join others in organizing against anti-gun legislation

- Find nearby gun shops, ranges, training, and other resources

- Discover free outdoor shooting areas

- Stay up to date on firearm-related events

- Share photos and video with other members

- ...and much more!

Stock market on fire

- Thread Starter Oregonhunter5

- Start date

-

- Tags

- stock

- Messages

- 5,749

- Reactions

- 18,151

- Messages

- 1,571

- Reactions

- 3,301

Get out that bear mace! S&P down 21.35% YTD and still has a long way to drop!

The many bubbles haven't even popped yet, with inflation still out of control and cost of living going up, this roll coaster is going down.

The many bubbles haven't even popped yet, with inflation still out of control and cost of living going up, this roll coaster is going down.

They took pretty extreme measures, including bumping key interest rates to ~20%. Our YoY inflation is ~8%, Russia is clocking in around 17%.Ruble has revalued upward 60 per US

Big correction taking place right now. All indexes jumped outside their trendlines during the 2021 COVID recovery fueled by Fed policies. Did it make sense for tech companies to triple, quadruple, or quintuple in value over the course of a year...nope.

S&P500 was 330 prior to COVID. A healthy trendline would have put it around it's average annualized return of 10%, or around 400 in 2022. We shot past that and hit 480 in 18 months.

Congrats if you sold at the top.

Gold Supporter

- Messages

- 24,651

- Reactions

- 37,412

NASDAQ down almost 5%, that's ugly.

- Messages

- 5,749

- Reactions

- 18,151

Bitcoin crashing, Binance annouced liquidating margin accounts, several exchanges cut withdrawals today. USDD (another stablecoin pegged to $1) is trying desparately to stay pegged, The other stable coins are shaking as well. UST (another stablecoin) is dead at $0.03 and never recovered from last time.

As you might remember, huge accounts with bitcoin are collateral for loans to leverage dirivatives, bitcoin is bought with USDT (Tether) which is supposed to be backed 1:1 with USD but some huge amount is backed by chinese paper like Evergrande which has defaulted like 100 times in the last several months and the rating agencies dont want to downgrade it because it is holding up this house of cards. So a huge part of the financial industry is held up by nothing, held up by nothing, held up by worthless chinese paper.

Reverse repos at new all time record of $2.2 trillion a day. If 97 major banks find that a reverse repo loan that pays 0.08% annually is better than any other option something isnt right.

The world jenga ponzi financial system is tipping

As you might remember, huge accounts with bitcoin are collateral for loans to leverage dirivatives, bitcoin is bought with USDT (Tether) which is supposed to be backed 1:1 with USD but some huge amount is backed by chinese paper like Evergrande which has defaulted like 100 times in the last several months and the rating agencies dont want to downgrade it because it is holding up this house of cards. So a huge part of the financial industry is held up by nothing, held up by nothing, held up by worthless chinese paper.

Reverse repos at new all time record of $2.2 trillion a day. If 97 major banks find that a reverse repo loan that pays 0.08% annually is better than any other option something isnt right.

The world jenga ponzi financial system is tipping

- Messages

- 5,749

- Reactions

- 18,151

Ok, if you guys want to watch the fun. Evergrande is finally getting delisted on Thursday.

Here is the market cap for tether:

https://coinmarketcap.com/currencies/tether/

https://coinmarketcap.com/currencies/tether/

Starting early April there has been about $11 billion removed from tether to probably take care of liquidations or just get out ahead of the crash. Now everyone knows that Tether isnt backed 1:1 with US dollars like it is supposed to be. Some percentage 50%? 70%? is backed by commercial paper and there might be a whole lot of Evergrande bond's they are using for collateral.

So at some point of this Tether "bank run" they are going to run out of dollars to give out and be left with worthless paper.

Once tether collapses, so does the entire crypto market. The stablecoins are being stressed to the max because everyone is trying to cash out.

Here is the market cap for tether:

https://coinmarketcap.com/currencies/tether/

https://coinmarketcap.com/currencies/tether/Starting early April there has been about $11 billion removed from tether to probably take care of liquidations or just get out ahead of the crash. Now everyone knows that Tether isnt backed 1:1 with US dollars like it is supposed to be. Some percentage 50%? 70%? is backed by commercial paper and there might be a whole lot of Evergrande bond's they are using for collateral.

So at some point of this Tether "bank run" they are going to run out of dollars to give out and be left with worthless paper.

Once tether collapses, so does the entire crypto market. The stablecoins are being stressed to the max because everyone is trying to cash out.

- Messages

- 17,471

- Reactions

- 36,484

- Messages

- 17,471

- Reactions

- 36,484

Coinbase lays off 18% of workforce as executives prepare for recession and 'crypto winter'.. Coinbase is having coins drained as people are moving them to wallets since they released a new customer service agreement that says if they go bankrupt they will be liquidating your coins to pay off debt.

Silver Lifetime

- Messages

- 42,854

- Reactions

- 111,321

Diamond Supporter

Platinum Lifetime

Platinum Supporter

Gold Lifetime

Silver Lifetime

Bronze Lifetime

- Messages

- 24,701

- Reactions

- 66,733

My 401ks and IRA are down $70,000 since the new year. $27,000 of that crash was just since last Thursday's close. Let's go, Brandon!

- Messages

- 5,749

- Reactions

- 18,151

Nothing like hearing the fraud right from the horses mouth:

" THE WHOLESALERS ARE PROVIDING INFINITE LIQUIDITY AT THE INSIDE PRICE"

The market makers, in the process if keeping the market liquid (shares alwways availabe to buy or sell) are creating (up to) an infinite number of counterfiet shares at any time based on the price they want. There is no supply and demand that prices anything in the stock market. the market makers can at any time can allow you to buy a counterfiet share at the price they want at any time. If the shares are hard to find, the price would normally (in a legal market) increase until someone wants to sell. In this market, if shares are not available, the market maker creates counterfiets to give you instead at the price that benefits them.

Combine that with internalization of purchases, dark pools, options and every other scheme they have, the stock market is purely fraudulant.

This is what Gensler meant when he said 95% of all trades never reach a lit market.

" THE WHOLESALERS ARE PROVIDING INFINITE LIQUIDITY AT THE INSIDE PRICE"

The market makers, in the process if keeping the market liquid (shares alwways availabe to buy or sell) are creating (up to) an infinite number of counterfiet shares at any time based on the price they want. There is no supply and demand that prices anything in the stock market. the market makers can at any time can allow you to buy a counterfiet share at the price they want at any time. If the shares are hard to find, the price would normally (in a legal market) increase until someone wants to sell. In this market, if shares are not available, the market maker creates counterfiets to give you instead at the price that benefits them.

Combine that with internalization of purchases, dark pools, options and every other scheme they have, the stock market is purely fraudulant.

This is what Gensler meant when he said 95% of all trades never reach a lit market.

Silver Lifetime

- Messages

- 42,854

- Reactions

- 111,321

Bim bam botta bing!

I am down $90K YTD

Ouch!

And I do not have any way to put any $ into them to buy while they are low, short of getting a job - which I do not want to do.

*sigh*

I am down $90K YTD

Ouch!

And I do not have any way to put any $ into them to buy while they are low, short of getting a job - which I do not want to do.

*sigh*

- Messages

- 5,749

- Reactions

- 18,151

- Messages

- 17,471

- Reactions

- 36,484

- Messages

- 17,471

- Reactions

- 36,484

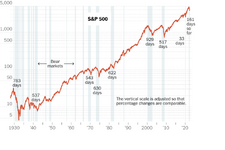

That graph is why I am mostly invested in Index Funds - QQQ / SPY etc.

I myself hope the bottom falls out. I got a substantial amount of dry powder waiting for just such an event.I wonder how the mortgage backed securities are doing? They have to be better than 2008 right? RIGHT?

View attachment 1221732

Staff Member

Gold Lifetime

- Messages

- 21,834

- Reactions

- 63,228

Share This Discussion

Similar threads

Upcoming Events

Support Our Community

If our Supporting Vendors don't have what you're looking for, use these links before making a purchase and we will receive a small percentage of the sale