- Messages

- 5,783

- Reactions

- 11,243

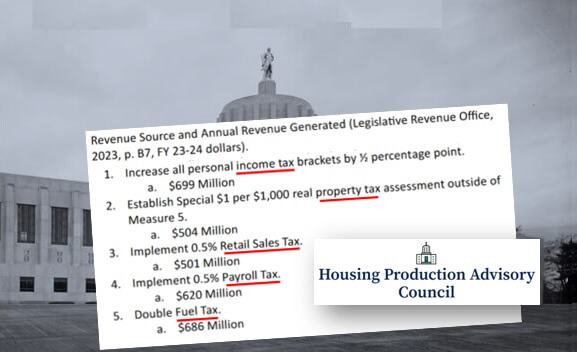

It really doesn't make sense for old folks to move to Idaho because of the sales tax. If you saved money in Oregon you paid taxes on income before you saved it. To move to Idaho you get taxed again to spend your money. Sell your house here and take the profit only to be taxed to spend it.