Silver Lifetime

- Messages

- 42,951

- Reactions

- 111,589

- Thread Starter

- #421

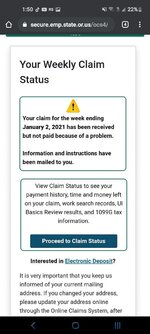

So, if you look at your OED claim status and it says there is a problem with your weekly claim, don't panic. Keep filing. The OED is apparently switching everybody over to the federal extensions. Some people are already getting the extra $300, but many are not and see the problem message.

Give it to the end of the week. The OED is probably overwhelmed now because of their archaic computer systems.

Give it to the end of the week. The OED is probably overwhelmed now because of their archaic computer systems.