- Messages

- 7,381

- Reactions

- 19,890

Appreciate your post. But I'm not clear about how inventory is "taxed". It is clear that money which is tied up in excess inventory certainly could be used for better purposes if that level of inventory can be reduced to some minimum level by freeing up working capital for other purposes. And hence the inducement for JIT principles.

But I think if there is any government "tax" on just holding inventory, it would be inconsequential.

I want you to imagine you are a business owner and whether you make a profit that year, or have net losses, the government will still tax you on all the inventory you have at your business regardless.

If you think that tax burden is "inconsequential" I don't think you understand the costs of running a business and how much taxes affect businesses.

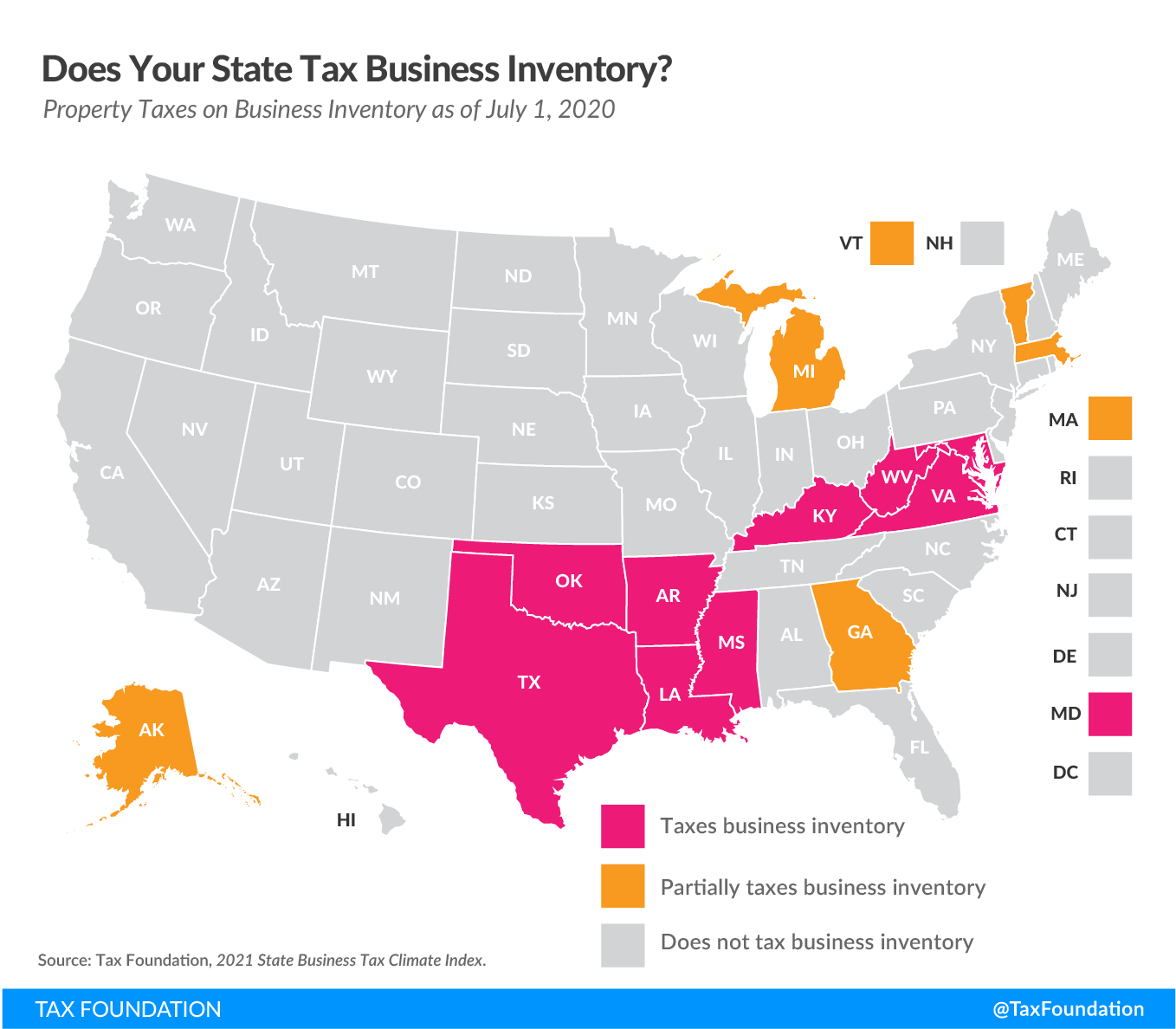

Does Your State Tax Business Inventory?

Nine states (Arkansas, Kentucky, Louisiana, Maryland, Mississippi, Oklahoma, Texas, Virginia, and West Virginia) fully tax business inventory, while five additional states (Alaska, Georgia, Massachusetts, Michigan, and Vermont) levy partial taxes on business inventory.