Gold Lifetime

- Messages

- 27,945

- Reactions

- 74,925

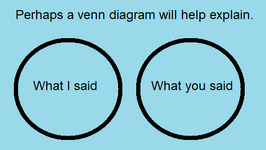

It's best to let sleeping dogs butter their bread.You did that on purpose! I haven't the foggiest idea what you're talking about and there is no way to Google it. Is it because ice cream doesn't have any bones?