- Messages

- 21,645

- Reactions

- 50,295

Other than often wishing I had worked harder to drop a C note on this stuff many years ago, never paid much attention to it since it got "mainstream" so to speak. So when I ran across this news story the last line got my attention. That the supposed "crook" would not give up his password so the Bitcoin was there in his account but, they claim he can never get it. So is there someone here who knows how this works that can say he really can't ever get it back or "cash it is" so to speak? Just how they make sure he can't?

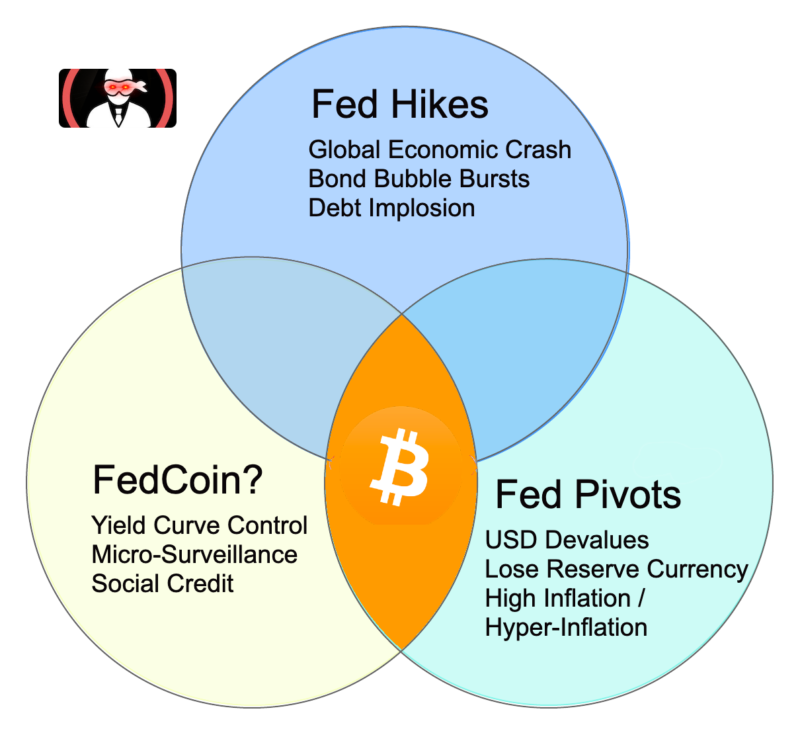

I have figured for a long time that those at the top in Government have to be working really hard to get control of this, is they have not already.

"Prosecutors have ensured the man cannot access the largesse, however."

Read Newsmax: Police Seize $60 Million of Bitcoin! Now, Where's the Password? | Newsmax.com

Important: Find Your Real Retirement Date in Minutes! More Info Here

www.newsmax.com

www.newsmax.com

I have figured for a long time that those at the top in Government have to be working really hard to get control of this, is they have not already.

"Prosecutors have ensured the man cannot access the largesse, however."

Read Newsmax: Police Seize $60 Million of Bitcoin! Now, Where's the Password? | Newsmax.com

Important: Find Your Real Retirement Date in Minutes! More Info Here

Police Seize $60 Million of Bitcoin! Now, Where's the Password?

German prosecutors have confiscated more than 50 million euros ($60 million) worth of bitcoin from a fraudster. There's only one problem: they can't unlock the money because he won't give them the password. The man was sentenced to jail and has since served his term...