Gold Supporter

- Messages

- 24,668

- Reactions

- 37,439

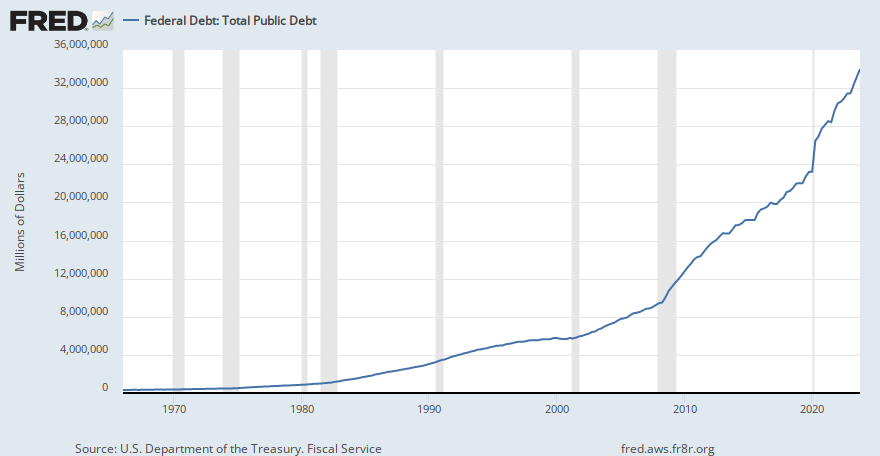

The average debt load for American households appears to be around $155,000 and growing:

"The average U.S. household with debt now owes $155,622, or more than $15 trillion altogether, including debt from credit cards, mortgages, home equity lines of credit, auto loans, student loans and other household obligations — up 6.2% from a year ago. "

Source: https://www.google.com/amp/s/www.cn...prices-us-households-fall-deeper-in-debt.html

That makes me feel better about my roughly $3500 in total debt. Where do you fit in compared to the average American. If you have joint debt with spouse/other cut those debts in half.

Edit: Average American debt (not household debt) is about $90,000 (2019 data):

Source: https://www.google.com/amp/s/www.cnbc.com/amp/select/average-american-debt-by-age/

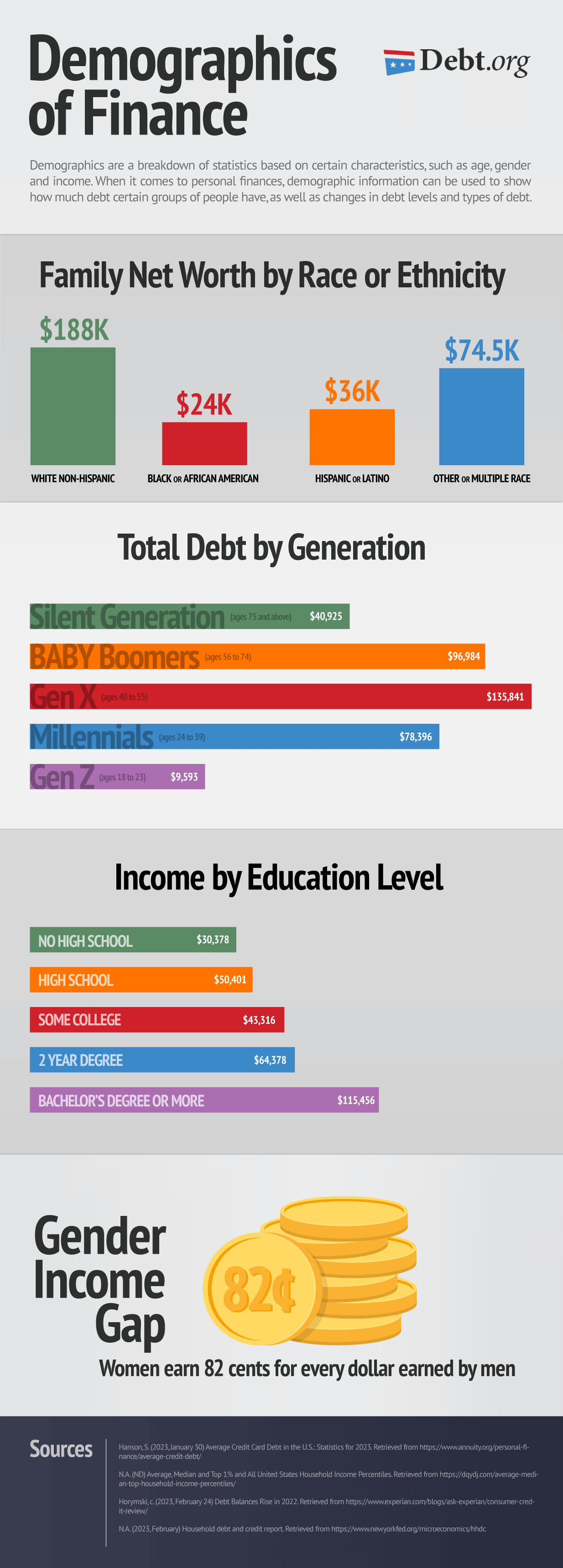

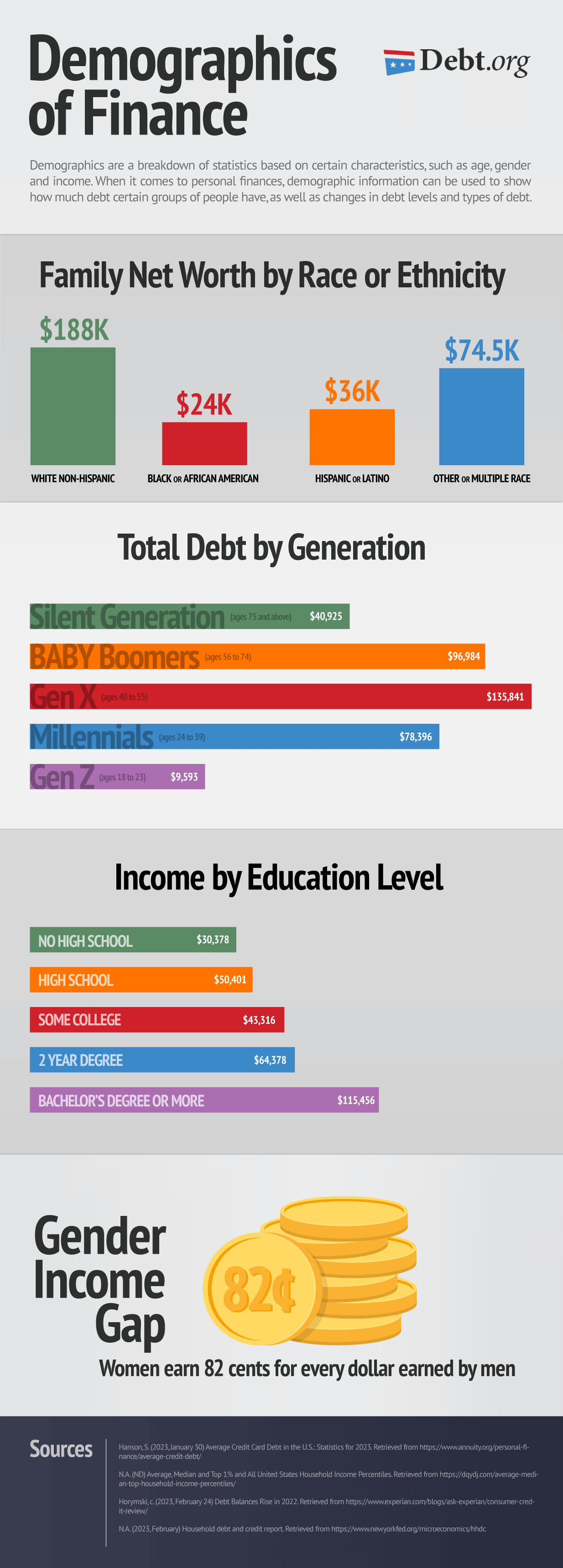

Updated per person debt report from 2021.

www.debt.org

www.debt.org

"The average U.S. household with debt now owes $155,622, or more than $15 trillion altogether, including debt from credit cards, mortgages, home equity lines of credit, auto loans, student loans and other household obligations — up 6.2% from a year ago. "

Source: https://www.google.com/amp/s/www.cn...prices-us-households-fall-deeper-in-debt.html

That makes me feel better about my roughly $3500 in total debt. Where do you fit in compared to the average American. If you have joint debt with spouse/other cut those debts in half.

Edit: Average American debt (not household debt) is about $90,000 (2019 data):

Source: https://www.google.com/amp/s/www.cnbc.com/amp/select/average-american-debt-by-age/

Updated per person debt report from 2021.

Debt In America: Statistics and Demographics

Learn about the demographics of consumer debt including age, gender, ethnicity, income, education level & family type, and how they impact Americans.

Last Edited: