Bronze Supporter

- Messages

- 16,593

- Reactions

- 35,458

I Do not think its near as empty as you think it isSince Mexico is near empty, I'm looking...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

I Do not think its near as empty as you think it isSince Mexico is near empty, I'm looking...

A joke. Actually DW and I are considering Antigua, Guatemala, as there is less crime than in the US. Less inflation. Less taxes. Some of the world's best coffee.I Do not think its near as empty as you think it is

Here we go again today as Mr. Whitehouse commandeers the Senate institution that is supposed to oversee taxpayer funds for yet another hearing devoted to his climate obsession and specifically an investigation of "Big Oil." Imagine how much waste, fraud and abuse Mr. Whitehouse's staff could uncover if directed to investigate the annual federal budget, currently soaring toward $7 trillion. Just think of what the committee staff might accomplish if Mr. Whitehouse would allow them to do the job taxpayers are paying them to do!

It's too kind to call this a dereliction of duty in ignoring our nation's budget crisis because if the result is more taxpayer funding for unproductive wind and solar projects then it makes the crisis even more severe. This is worse than neglect.

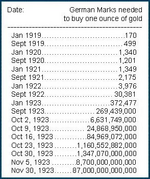

The thing is the fact the US Dollar is still the leading world reserves currency, and has been since the Bretton Woods Agreement of 1944, and then the Jamaica Accords of 1976.. so, unlike Zimbabwe or Venezeula's economies where hyperinflation destroyed many things, or even unlike the Wiemar era (interwar) where inflation had an outsize effect on political climate in Germany, and when Great Depression happened to the US... the fact that the USD is the world reserve currency means that if the US economy completely implodes, so does the economies of much of the world, that's tied to the USD. At least, from this plebian's point of view as a non-economistI've been hearing about this national debt thing being the nail in the coffin that brings down the country for good since I was old enough to register such a thing.

~40 years later and continuous, exponential increases in the debt, here we still are, talking about how it's going to kill us all.

I guess I'm just not convinced it's really the big boogieman it's made out to be. That's not suggesting that it's a GOOD thing, however, just for those who like arguing for the sake of arguing.

We have created and are actively fueling the initiative to move to an alternative currency by removing ourselves from the world market for crude oil. Why should there be a petro dollar if the US is not participating in influencing the market price of crude. We have among the highest crude and gas reserves in the world and could lower the price of crude and gas significantly by putting more supply onto the world market. Instead we withdraw from actively participating as a supplier of crude/gas.The BRIC's (Brazil, Russia, India, and China) want to replace the dollar with another world currency. The problem is that there i ysn't another currency that is nearly as reliable. That will have to change in order for the dollar to be replaced.

Imagine you saved fiat dollars for decades to support retirement and then hyperinflation made it worth the value of the paper it was printed on. That would be demoralizing.No burst, just more hyperinflation putting thousands monthly onto the streets.

and

nearly half of Boomers have nothing saved for retirement.

To say the least.Imagine you saved fiat dollars for decades to support retirement and then hyperinflation made it worth the value of the paper it was printed on. That would be demoralizing.

Because the Dollar is still the leader for world reserve currency, so if the US Economy implodes and the dollar becomes worth as much as toilet paper, much of the world's economies will also collapse and implode, in particular those that hold their reserves in US Dollars?I'm pretty dumb when it comes to international banking, the fed reserve, national debt etc...

I simply don't understand why the debt hasn't brought us down yet..

Another milestone..article five days ago. Just the debt interest payments alone are going to surpass defense spending

View attachment 1888379

Would have been something had .world not pretended Russia was still Soviet Union, and brought them into the EU.Because the Dollar is still the leader for world reserve currency, so if the US Economy implodes and the dollar becomes worth as much as toilet paper, much of the world's economies will also collapse and implode, in particular those that hold their reserves in US Dollars?

Edit. If (and when) the world replaces the US Dollar as the leading reserve currency; but with what? Then the US economy will collapse and implode and hyperinflation will set in, and then the fireworks, the warfare, the end of the US dominance in economies... all will be a fell doom on the Americans still here. Just my opinion. Right now, I don't think there's any other country whose currency and political status has been as secure/trustworthy/stable as the US, not even Japan or UK, and many countries are loath to trust the Chinese currencies.

Russia could never be trusted. It has never progressed past a society based on rank and power, whether it be aristocracy, communist, or authoritarian kleptocracy. The fall of Communism brought out the worst in the Russian authorities, and the worst of the Capitalist exploiters. There was no hope of bringing Russia into the fold. It wasn't ready yet, never having known anything but the iron fist of the overlords, and the Capitalist exploiters were of no help.Would have been something had .world not pretended Russia was still Soviet Union, and brought them into the EU.

How strong would the Euro be?…

One wonders.Would have been something had .world not pretended Russia was still Soviet Union, and brought them into the EU.

How strong would the Euro be?…

And here is where we get what is called a conundrum. Because as in institution, the US Government needs the lowest possible inflation rate to minimize the damage that the debt is incurring. On the other hand, interest rates with meaningful yield are needed to rein in reckless borrowing and various deposits that require yield as an offset to inflation.Another milestone..article five days ago. Just the debt interest payments alone are going to surpass defense spending

The Chinese are actively bailing from USD instruments for this very reason. They are trying to unload as much as they can before they get stuck holding the bag. China "only" holds 2 to 3% of US debt, but their retreat from it is symbolic.Because the Dollar is still the leader for world reserve currency, so if the US Economy implodes and the dollar becomes worth as much as toilet paper, much of the world's economies will also collapse and implode, in particular those that hold their reserves in US Dollars?

It's possible that the world may enter an era when there is no single reserve currency. Or maybe a consortium of currencies may take over, something akin to the SDR. Or maybe there is something to the fact that central banks around the world are bulking up on holdings of gold, the "barbaric relic." It's only been 53 years since sovereign trade balance accounting was done with gold.Edit. If (and when) the world replaces the US Dollar as the leading reserve currency; but with what? Then the US economy will collapse and implode and hyperinflation will set in, and then the fireworks, the warfare, the end of the US dominance in economies... all will be a fell doom on the Americans still here. Just my opinion. Right now, I don't think there's any other country whose currency and political status has been as secure/trustworthy/stable as the US, not even Japan or UK, and many countries are loath to trust the Chinese currencies.