- Messages

- 5,749

- Reactions

- 18,151

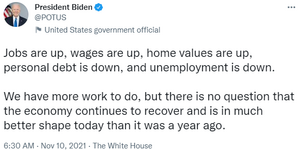

Inflation (new calculation that does not include housing because the government considers that an "investment") at 6.2% Yellen or Powell or one of the other feds that retired suddenly after selling all their stock should be out soon to tell us this is temporary. So not to worry. Oh look, SPY is at a all time high. The market rocketing into space while people cant afford milk. Evergrande defaulted again. I wonder if they will be given another month to pay their debts and not pay again.