- Thread Starter

- #1,421

A corp (business entity) you can. A non business entity (trust) is not expressly allowed, but.... it's worth the ol college try(?).....not a corp or trust.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

A corp (business entity) you can. A non business entity (trust) is not expressly allowed, but.... it's worth the ol college try(?).....not a corp or trust.

How can a corp be on 4473 if a trust can't (according to wa gun law guy)? Neither are individuals. And he says you have to be an individual to be on form 4473. It doesn't sound right.A corp (business entity) you can. A non business entity (trust) is not expressly allowed, but.... it's worth the ol college try(?)

Its lawyers nitpicking. The ATF probably doesn't give a damn.How can a corp be on 4473 if a trust can't? Neither are individuals.

This whole thing about trusts can't own a title 1 firearm does not make sense to me. Individuals can act in their capacity as officer of corp why can't individual be the (inset proper term here whether co-trustee responsible person whatever).

I think you are right on that. I bet if you got a bunch of lawyers together they would have many different opinions but just a guess. ATF is acting on the info provided such as notarized trust with list of firearms owned by the trust, photos, etc.Its lawyers nitpicking. The ATF probably doesn't give a damn.

I believe he was speaking in the context of your average every day gun owner adding their title I to a trust, which is technically correct. Not... a business entity transferring a title I into the possesion of a business. For the sake of the pistol brace rule, it's not germane.How can a corp be on 4473 if a trust can't (according to wa gun law guy)? Neither are individuals. And he says you have to be an individual to be on form 4473. It doesn't sound right.

This whole thing about trusts can't own a title 1 firearm does not make sense to me. Individuals can act in their capacity as officer of corp why can't individual be the (inset proper term here whether co-trustee responsible person whatever).

The grantor/trustee assigns trust property. While we can argue Oregon specific 4473 laws for most states simply the act of assigning property to the trust transfers ownership of that property to the trust. It doesn't have to be a titled piece of property to be trust property. Many non state titled and registered items exist in valid trusts.To add though... in states that require a 4473... it's abjectly incorrect that simply writing down the firearm info on a piece of paper transfers ownership to the trust. No transfer of ownership, required by law, has taken place.

As discussed in the other thread, it seems to still be allowed as simple property for specfic purposes, but doesn't constitute an ownership transfer/gift.

That's how I see it too. The purpose of 4473 as I understand it is not to transfer ownership. It's purpose is bgc and for record retention for atf. I have posed this question to a gun trust guy but no response and I doubt I'll get any.The grantor/trustee assigns trust property. While we can argue Oregon specific 4473 laws for most states simply the act of assigning property to the trust transfers ownership of that property to the trust. It doesn't have to be a titled piece of property to be trust property.

That's how you and wa gun law guy see it. I'm not saying you're wrong cuz I don't know, but some gun trust outfits and attorneys do say it has taken place. For me I don't see where 4473 transfers ownership. It allows for bgc and record keeping. It's the same person on bgc whether Its in their trust or not in their trust. It's the same person, and their property to put into trust if they want is how I see it until I hear otherwise from attorneys and/or gun trusts that know.... No transfer of ownership, required by law, has taken place...

Simple property, yes. No one has disputed that well known fact.The grantor/trustee assigns trust property. While we can argue Oregon specific 4473 laws for most states simply the act of assigning property to the trust transfers ownership of that property to the trust. It doesn't have to be a titled piece of property to be trust property. Many non state titled and registered items exist in valid trusts.

I see it as property that has a required bgc component, not property on a title or deed.Simple property, yes. No one has disputed that well known fact.Titled/registered property must be retitled/reregistered in the name of the trust for the trust to "own" it. In the case where state law required legal transfer of ownership... you can't simply "give/gift" ownership to a trust entity by means of writing it down on a piece of paper.

Like a home/vehicle/bearer bonds/bank accounts, etc.... ownership must be legally transferred.

How is that such a difficult concept to grasp?

No but guns , in most situations are not titled property and yes I can add whatever I want to a trust as the grantor/trustee that is not a piece of titled property. Since thats what we are talking about, title 1 guns, they can be transferred to a trust by the trustee and are regularly. No one gives a damn about cars. The 4473 isn't a registration document.Simple property, yes. No one has disputed that well known fact.Titled/registered property must be retitled/reregistered in the name of the trust for the trust to "own" it. In the case where state law required legal transfer of ownership... you can't simply "give/gift" ownership to a trust entity by means of writing it down on a piece of paper.

Like a home/vehicle/bearer bonds/bank accounts, etc.... ownership must be legally transferred.

How is that such a difficult concept to grasp?

Partially yes. A 4733 is simply the transaction record, however, it is well established what "transfer" means and what state law requires to accomplish a legal transfer. "Ownership" is maybe not the best word and comes down to splitting hairs a bit(?)That's how I see it too. The purpose of 4473 as I understand it is not to transfer ownership. It's purpose is bgc and for record retention for atf. I have posed this question to a gun trust guy but no response and I doubt I'll get any.

Call it what you want. Believe you know what you know... I may not have worded it to absolute satisfaction, but the point remains that some states require a 4473 to make legal transfer of a title I firearm. There is no ambiguity there and there is no written law that specifically allows a firearm to be gifted or simply assigned to a legal entity. To specific associated persons... yes. A trust isn't one of them.No but guns , in most situations are not titled property and yes I can add whatever I want to a trust as the grantor/trustee that is not a piece of titled property. Since thats what we are talking about, title 1 guns, they can be transferred to a trust by the trustee and are regularly. No one gives a damn about cars. The 4473 isn't a registration document.

You have just convinced me 100% that the trust can own title 1 firearms w/o issue if no non-family members are in the Trust.Partially yes. A 4733 is simply the transaction record, however, it is well established what "transfer" means and what state law requires to accomplish a legal transfer. "Ownership" is maybe not the best word and comes down to splitting hairs a bit(?)

View attachment 1356509

That's one way to interpret it.You have just convinced me 100% that the trust can own title 1 firearms w/o issue if no non-family members are in the Trust.

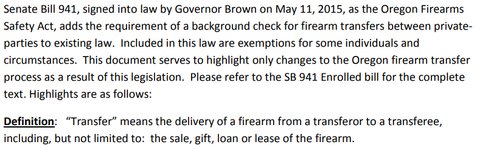

The state background law from 2015 purpose was to close the private party to private party sale without a background check. But it allows transfer to a wide range of family without a bgc.

So for the case of an individual that owns the firearm transferring it to his trust and there are no trust members that are ourside the family (as defined below) I see it as 100% fine. Thx!

View attachment 1356514

The nexus is the background check law. No new background check would be required. The background check is for the individual. All the individual(s) don't require bgc(s) if they are family members. The purpose of the 2015 law is to make sure private party transfers have a bgc for the individual it's transferred to. If the people are exempt from that law it would pass that with flying colors. You can't run a background check on a block of wood (ie an entity that is not a person).That's one way to interpret it.Will a court agree with you? A trust entity is a seperate entity from any individual named in that trust. Non-family member or not... each is a seperate and unique entity. You are not transferring/gifting your firearm to a specific or group of trustees... you are transferring it to the trust itself.

You have no familial relationship to any legal entity. Hence it does not fall into the laws that provide for gifting to a familial relationship outlined in those provisions.

Breaking it down into it's simplest form... here's another way to look at it.

In OR, 941 requires a 4473 and BGC to be completed for all private party transfers.

You are a private individual. A trust is a seperate private legal entity. Therefore, a 4473 and BGC is required. By simply writing it down/assigning a title I to your trust, has a 4473 and BGC been completed? No. Therefore... under OR law... has a legal transfer taken place? No.

Tust laws on simple property assignment may be in contradiction to OR law pertaining to firearms transfers, but does one law trump the other or we as individuals just get to decide which to apply (ignoring the ones we don't like) in order to accomplish our end goal... or not(?)

The way laws work.. you must comply with each related law even when it is not specifically contained in each of the applicable laws.

Is is though. It may not "seem" to make sense since "you" are "you".. acting as an individual or as a trustee (appointed by yourself), but in the eyes of the law, those are two different entities. You are "you" as an individual... transferring a firearm to a seperate entity... the trust... and "you the trustee" are simply the authorized agent of the trust entity.The nexus is the background check law. No new background check would be required.