- Messages

- 18,744

- Reactions

- 45,455

How knows? It can change at a moment's notice.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

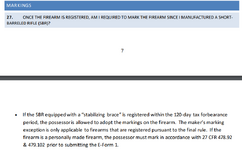

Hard to say. Their FAQ asks, "Do I need to mark the firearm after it is registered?" The answer says there is a special exception for this rule where people can adopt the manufacturers markings. If one still has to engrave new markings, why this answer and why the special exception for this rule only? It says after it is registered, not at time you submit form 1.There may be some confusion in that the markings section is referring to "for registration purposes", but once the stamp is approved then futher engraving is/may be required to be in full compliance. If you do the full engraving before or after doesn't matter, but the minimum requirment must be met and included at the time you submit your form-1.

At least that's been my take-away from all the back and forth.

Perhaps they should think about changing the form instructions then because they clearly state if must be engraved with makers marks?Hard to say. Their FAQ asks, "Do I need to mark the firearm after it is registered?" The answer says there is a special exception for this rule where people can adopt the manufacturers markings. If one still has to engrave new markings, why this answer and why the special exception for this rule only? It says after it is registered, not at time you submit form 1.

View attachment 1355588

Kind of makes me wonder if we may see a revised form 1 and/or revised instructions on Jan 31, or whatever day they publish the rule in the fed register. Maybe that's why they have been holding off publishing it. Who knows.Perhaps they should think about changing the form instructions then because they clearly state if must be engraved with makers marks?

Every states transfer and trust laws may differ. When the majority of NWFA members reside in states that require 4473's for private transfers, "of course you can" statements aren't entirely accurate. That may be true in some states that don't require 4473's for private transfers but it by no means applies to everyone... and "here"... it would be the exception, not the rule.I get that, but the problem I see is with firearms, they are registered to somebody. Or Something.

As you well know, a NFA item registered to an individual can't just be put into a trust, which is what the pair of shoes analogy would suggest. It needs to be transfered into the trust. Why is that different than a title 1 firearm?

I don't agree though, that there is no way to transfer a regular firearm into a trust. I don't see it any differently than transferring a regular firearm into a Corp.

If I were to buy a firearm for my company, an S Corp, there's a few extras I need to do and some requirements to be met, but it's the company firearm and would need to be transfered out if it were sold. Even if it was back to me.

How would that be any different if it were a trust?

It might be a question for an attorney. Or god forbid, a question to the atf (yikes!).Every states transfer and trust laws may differ. When the majority of NWFA members reside in states that require 4473's for private transfers, "of course you can" statements aren't entirely accurate. That may be true in some states that don't require 4473's for private transfers but it by no means applies to everyone... and "here"... it would be the exception, not the rule.

For states that do require a 4473, as an individual you cannot... although... it's still done as assigning personal property control for the purpose of disposition of property outlined by the trust... which hasn't really been challenged yet, so... ""kinda yes, you can" so long as it still works for the intent and purpose of most folks. IE., Estate planning.

That may be simply that the trust "legalize" simply hasn't caught up to the fact that in, OR for example, 4473's are "technically" now required. A trust attorney telling you it's okay may simply be unaware of the "newer" firearm related laws, but then again... we go back to.. if it is serving the same purpose for administrative control assigment for disposition purposes... who gives a rat's patooty... right?

The question becomes, will the alphabets accept it for the purpose of NFA'ing a title I or not. For states that require a 4473, we simply don't know yet until approvals go through or if denials come back for that reason. "Not in a trust prior to the final rule publishing". How deep are they going to base it on individual state laws... or.... just let it slide(?)

NOW... having covered "as an individual you cannot"... there "may" be some legal maneuvering where a trustee CAN. That's currently debateable, but as @SCARed was alluding to... it "may" be possible the same as a business entity transaction. Although the 4473 "technically" restricts it to "business entities"... some gun trust attorneys are postulating that you can list yourself as "name, trustee of [trust name}", provide the additional affidavit to the alphabets (per the transfer/purchase by a business entity instructions), sign at the bottom as "name, trustee" and you're good!

Documenting the 4473 completed as such (photo) for the paper trail and it "may" be allowed. That hasn't been challenged yet so... legal or not... no one can say with any surety.

If you are purchasing as the trustee then using a trust account for the funds would strengthen your paper trail/claim that it was purchased by the trust and not the individual.

Each trustee must complete a 4473 in the same way and fully documented so it is not confused as a transfer to each trustee consecutively as individuals.

Will it hold water? No one knows, but it's been actively being tried. Not for the pistol brace rule but for red flag protection. The nutshell: The trust containing a clause that a trustee found to not be legally able to possess is invalidated so the firearm is no longer under their control as trustee and LE must surrender it to the legal owner/s.... namely, one of the other trustees. Circumventing confiscation.

The only thing I've heard on that strategy is that it seems to fall more onto the discretion of LE if they accept that premise and will release firearms to another trustee or not, but I'm not aware of any case when LE chose not to, it was legally challenged, and the firearms ultimately released to another by using that "loophole". Sounds more like... if LE buys it... great! If not... there may not be anything you can do about it(??) We'll see.

I guess the whole "nutshell", would be: An individual cannot for legal ownership purposes in states that require a 4473, but it may be possible as an authorized person under the business entity provision. Although... untested, and more of a "don't ask, don't tell" loophole, IMHO. There really is no standing to argue that a trust is a "...or other business entity" for 4473 purposes.

YMMV

#1 A personally owned title I transfer to another private entity would be a private transfer and not all states require a 4473.It might be a question for an attorney. Or god forbid, a question to the atf (yikes!).

#1 Not sure that Oregon is unique. I've read that every state requires a 4473 if purchasing from a licensed dealer.

#2 The same person can own the firearm and be on the trust. There are examples from attorneys who said to give the ffl a statement that the firearm is owned by the trust. The individual signs the 4473 (only individuals can be on the form) and gives the ffl a statement that gun trust owns the gun to be kept with the 4473 in the ffl's file.

So to me it's still unclear.

Seems like the bgc is the core of the issue. OR requires bgc for the transfer. ATF doesn't want to approve anything that would violate state law.#1 A personally owned title I transfer to another private entity would be a private transfer and not all states require a 4473.

#2 That's the crux. That is a provision for transfer to a "business entity", but by definition, a trust is not. It boils down to if the alphabet will accept a trust under that provision or not.. which to my knowledge... has yet to be challenged or established as "good law".

Along with the affidavit to be included with the 4473, the "individual" name must specifically include, "Name, trustee of [trust name]" and sign it "name, trustee" as provided by most every state law when acting in that capacity (vs. as an individual).

It very well may hold water, but at this point... "technically" it's doesn't. Falling under, "let's try it and see if it flys", IMHO.

Even if it doesn't fly I doubt there would be any serious repercussions under the defense that you were doing so in accordance with professional legal advice without "intent" to circumvent the law. Also, if your title I makes it through the process, is approved as an NFA and legally trasferred to your NFA trust I highly doubt the alphabet could go back and "undo" it. They accepted it and what's done is done!

It's a mixed bag since it's not exactly "established law" and really could go either way. Some attorney's will say you can and others, no. However, there ARE people doing it. What has yet to be seen is if it holds up in court or if the alphabet even cares or not... simply accepting trust transfers under the "business entity" provision as an inclusion omission in the text of the 4473 instructions.Needs an attorney's answer probably or someone that has already done it in the recent past.

I agree with everything except the very clearly does not part. I would say it's very unclear.It's a mixed bag since it's not exactly "established law" and really could go either way. Some attorney's will say you can and others, no. However, there ARE people doing it. What has yet to be seen is if it holds up in court or if the alphabet even cares or not... simply accepting trust transfers under the "business entity" provision as an inclusion omission in the text of the 4473 instructions.

That seems perfectly reasonable, but I don't think anyone really has a definitive answer... and I dunno if anyone really WANTS to... including the alphabet. As long as there is no wrong doing the "no harm no foul" rule applies(?)

IF I had a title I I wanted to add for the purpose of applying for a tax stamp and to eventually have my firearm end up in my NFA trust.... "I" would certainly do it. (Do a 4473 for it as a trustee with an affidavit).

What I wouldn't do as an OR resident is assume just because I added a title I to my trust as simple property that it is now "owned" by the trust for application purposes. It very clearly does not, even if you might still get away with it.

Yeah.. there can be some gray area in the distinction between assigning simple property control to a trust vs. "ownership", but as it was explained to me... any titled/registered property must be retitled/reregistered in the name of the trust to establish "ownership". IE., homes, autos, etc etc.I agree with everything except the very clearly does not part. I would say it's very unclear.

From my understanding.... you're good to roll with a full stock once your application is in and covered by the amnesty. Either way you still have to take a copy of your application with your firearm no matter where you take it until the stamp goes through, but an SBR "amnesty" is "amnesty" and doesn't list any exclusion.Question. Once all the paperwork, fingerprints, whichever photos requested such as lower markings apparently and other markings If applicable, and possibly whole gun (haven't gotten a request for that yet); are submitted... for this specific rule; is there still a constructive possession possibility if say, someone ordered a real stock to replace the brace, but they haven't gotten the stamp yet?

IOW, keep brace on until stamp arrives, or go ahead replace?

It's how I read it too but considering that ATF says it (amnesty) applies only to pistol braced rifled barrel firearms and not to mere lower/no upper or to stripped lowers.. knowing the usual Form 1 says no putting together until stamp clears.... I wonder if there would still be that problem?From my understanding.... you're good to roll with a full stock once your application is in and covered by the amnesty. Either way you still have to take a copy of your application with your firearm no matter where you take it until the stamp goes through, but an SBR "amnesty" is "amnesty" and doesn't list any exclusion.

Did they change that in the final-ish rule? When it came out they said you were ok to keep the brace until approval and then switch to a stockFrom my understanding.... you're good to roll with a full stock once your application is in and covered by the amnesty. Either way you still have to take a copy of your application with your firearm no matter where you take it until the stamp goes through, but an SBR "amnesty" is "amnesty" and doesn't list any exclusion.

Good question. I haven't had time to read the full published "rule" thingDid they change that in the final-ish rule? When it came out they said you were ok to keep the brace until approval and then switch to a stock

I dunno. I was basing my understanding soley on the fact that... as they said... proof of your successful application is acceptable proof that you are now in compliance with the new SBR rule and your SBR is considered exempt from arrest or prosecution, except in the event your stamp application is ultimately denied. [paraphrasing]Did they change that in the final-ish rule? When it came out they said you were ok to keep the brace until approval and then switch to a stock