- Messages

- 3,596

- Reactions

- 7,235

William Devane...where's old Bill and his Rosland Capital pitch?

When I buy gold, blah, blah, blah...

When I buy gold, blah, blah, blah...

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You might be thinking of a different schiff for brains - Adam SchiffSchiff will say literally anything to criticize Trump.

I think you're right.You might be thinking of a different schiff for brains - Adam Schiff

Traditionally, gold has been the primary metal used in the production of jewelry, because of it's beauty and malleability. A little more than 50% of gold demand comes from jewelry production.Gold, like everything else, is only so valuable as determined by how it is desired by others. Basic laws of supply and demand.

What doesn't make sense however, is why gold is sought after. (Traditionally, not counting the application it is used for with technology today)

It's just a shiny rock, has no practical value or use for the common man and seemingly the only reason why others desire it is because it is an agreed upon method of exchange. The same could be done with any item chosen to act as currency.

Why are the hawkers of precious metals always so will to exchange it for worthless fiat currency?

My point above was to the guys crying out that gold could reach $4000/oz, so quick, come buy mine!!! Curious why they don't just keep it and wait for that peak.

I've always found it rather laughable that in some type of major incident that someone who is starving, but with a lot of shiny rock, is going to be able to trade that shiny rock for food.

I have been hearing the same thing about precious metals since the Carter years....

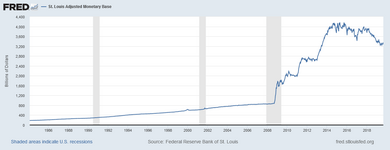

Ooopppppssssssss.Look at what has happened to the currency supply since 1984:

View attachment 616083

We are in a whole different world than we were in before the 2008 financial crisis, much less during the 1970s.

The US economy and population didn't suddenly expand in 2008, quite the opposite. The Fed cranked up the printing presses and started dropping money on Wall Street from helicopters to prop up a system that is starting to fail. Expansion of the currency supply = inflation. We haven't felt it too much yet because we have been sending many of those dollars overseas for TV sets and Chinese junk at Walmart. But eventually those dollars are going to come home to roost.

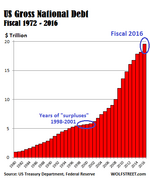

Meanwhile, look at the national debt since 1980

View attachment 616092

Before an earthquake stress builds and builds and builds. Everything seems just fine on the surface, the weather is nice, and life is good. But underneath the surface stress is building and building. And then one day the fault line slips, the built up energy is released, and it hits without warning, causing devastation. Just as with geological stress on a fault line, financial stress continues to build. Everything will seem fine until it breaks. Like with an earthquake, no one knows for sure when the next financial crisis will hit. But when it does, as with an earthquake, some will be prepared, and some won't be.

Troubling news in the world of finance: Peter Schiff: China, Russia buying gold because 'they can read the writing on the wall'.

My thought is that for gold to be valuable in any 'collapse', enough people would have to agree that it is indeed a worthwhile medium of exchange. I'm not sure modern society would be very quick to do that. If our currency somehow becomes suddenly worthless, and we slide close to a SHTF situation I can't think of any supplies I would be willing to trade for gold. What's it's use case in today's world? Nobody will be making semiconductors or gold chalices, etc. I just don't buy it, so to speak.

My thought is that for gold to be valuable in any 'collapse', enough people would have to agree that it is indeed a worthwhile medium of exchange. I'm not sure modern society would be very quick to do that. If our currency somehow becomes suddenly worthless, and we slide close to a SHTF situation I can't think of any supplies I would be willing to trade for gold. What's it's use case in today's world? Nobody will be making semiconductors or gold chalices, etc. I just don't buy it, so to speak.

I would think that during a shtf event, that arms and ammo would be of significant barter value.

www.thetruthaboutguns.com

www.thetruthaboutguns.com

Well there is that too, just have to make sure you get the drop on any potential criminal activity against you. Never do a deal alone, I prefer the buddy system.Probably not wise to barter something that can be turned against you.

Barter Smarter... Don't Trade Away Guns or Ammo - The Truth About Guns

◀Previous Post Next Post▶ Almost everyone in America has watched as southeast Texas bears the brunt of Hurricane Harvey. At the same time, disasters like Harvey happen with some regularity. In the aftermath of disaster, barter skills can save you time and trouble. Or executed poorly, they...www.thetruthaboutguns.com

Stop: Don't Barter Your Ammunition Away

It's often said that ammunition will be the new currency when the SHTF. Here's why that way of thinking could get you killed.gundigest.com

People will always need a medium of exchange because barter is not an efficient method of commerce. It may work for limited purposes on a small scale, but an economy cannot run on barter. So, there's that.My thought is that for gold to be valuable in any 'collapse', enough people would have to agree that it is indeed a worthwhile medium of exchange. I'm not sure modern society would be very quick to do that. If our currency somehow becomes suddenly worthless, and we slide close to a SHTF situation I can't think of any supplies I would be willing to trade for gold. What's it's use case in today's world? Nobody will be making semiconductors or gold chalices, etc. I just don't buy it, so to speak.

|

Not really. There are few elements that meet the specifications for an ideal money and none do as well as gold. It hasn't been the ideal type of money for 5,000 years for no reason.

That can be said of anything.I simply have never perceived it as valuable beyond what others may be willing to exchange for it,

Gold has the advantage of liquidity. In a pinch it can be sold quickly and easily at market value. Try that with a 5 gallon bucket of rice.it would make more sense to put my effort into procuring what I want originally, rather than something I don't want in the hopes of exchanging it.