- Messages

- 17,471

- Reactions

- 36,484

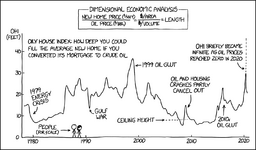

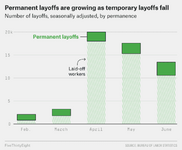

Evaluate your retirement portfolio

realinvestmentadvice.com

realinvestmentadvice.com

Real Investment Daily

Real Investment Daily Section of RIA Advise. Come see all of our daily posts in this section for review today.