Navigation

Install the NWFA app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More Options

You are using an outdated browser

The browser you are using is likely incompatible with our website. We recommend upgrading your current browser or installing an alternative.

JavaScript is disabled

Our website requires JavaScript to function properly. For a better experience, please enable JavaScript in your browser settings before proceeding.

-

Join the #1 community for gun owners of the Northwest

We believe the 2nd Amendment is best defended through grass-roots organization, education, and advocacy centered around individual gun owners. It is our mission to encourage, organize, and support these efforts throughout Oregon, Washington, Idaho, Montana, and Wyoming.Free Membership Benefits

- Fewer banner ads

- Buy, sell, and trade in our classified section

- Discuss firearms and all aspects of firearm ownership

- Join others in organizing against anti-gun legislation

- Find nearby gun shops, ranges, training, and other resources

- Discover free outdoor shooting areas

- Stay up to date on firearm-related events

- Share photos and video with other members

- ...and much more!

Is this a bad time to buy silver?

- Thread Starter So Low 2

- Start date

Diamond Lifetime

- Messages

- 6,124

- Reactions

- 13,918

I think it closed at around $17.15 today

- Messages

- 60

- Reactions

- 71

- Thread Starter

- #23

I appreciate all the responses. Dont have any silver at the moment, and was just thinking about having a little, to prep for another possible scenario.

Diamond Lifetime

- Messages

- 6,124

- Reactions

- 13,918

If you are buying to have as barter bait I would recommend 90% junk silver dimes. A better thing to have than ounce rounds if you are trading.

- Messages

- 2,858

- Reactions

- 4,116

I think that as an 'investment' silver is a pretty poor choice. I did accumulate a goodly quantity of it over the years though, and when I had to sell most of it to pay for a family members medical bills I was glad that I had it.

I am going to send you a PM over something I have found to be true when it comes to buying. You can check out the statistics yourself if you choose.

I am going to send you a PM over something I have found to be true when it comes to buying. You can check out the statistics yourself if you choose.

- Messages

- 10

- Reactions

- 6

Buying precious metals is a bet against fiat currencies.

All fiat currencies eventually go to zero.

Think about how much value the dollar has lost in the last 40 years.

"Bets" should never be thought of as investments, but that doesn't mean you should never make them.

Insurance is a bet. You make a small wager every year that your house will burn down.

Both you and the insurance company hope you lose the bet.

PMs can be thought of as "unsurance". Owning a little bit in case of a currency collapse is ok.

But I'd only buy after getting rid of debt, maximizing income, and having actual investments.

All fiat currencies eventually go to zero.

Think about how much value the dollar has lost in the last 40 years.

"Bets" should never be thought of as investments, but that doesn't mean you should never make them.

Insurance is a bet. You make a small wager every year that your house will burn down.

Both you and the insurance company hope you lose the bet.

PMs can be thought of as "unsurance". Owning a little bit in case of a currency collapse is ok.

But I'd only buy after getting rid of debt, maximizing income, and having actual investments.

- Messages

- 1,703

- Reactions

- 1,573

I've bought silver, in coins, over the past several years from several mints around the world. If you are just buy ingots then you really only have spot value to work with. Coins however may have added value of their own. I was checking some series 1 Chinese lunar coins made in Perth that I bought a while back and their value had risen 400% over about the 5 years since I bought them. So, it depends on what you buy as well.

Edit to add, I got some US mint 5 oz replica quarters recently. Some where 200-ish but the Olympic National Park ones, in particular, were only about 120-ish each. The 5 and 10 oz coins are cool to look at too.

Edit to add, I got some US mint 5 oz replica quarters recently. Some where 200-ish but the Olympic National Park ones, in particular, were only about 120-ish each. The 5 and 10 oz coins are cool to look at too.

Last Edited:

- Messages

- 247

- Reactions

- 289

High was at $46.08 in 2011. Just recently it had bottomed out at $13.88.

You also have to consider the dealers markup, which is around .40 cents an ounce whether you're buying or selling.

My advice is to have a hobby that makes you extra non taxable cash that you can use to free yourself from any and all debt.

Very good advice. Skills are the ultimate bartering item, especially skills that will be needed during a type of scenario where others are buying silver to use as currency. Skills like gardening/growing & processing food, repair (home, car, firearm, etc.), basic medical, making alcohol.

At best precious metals are a stable currency during a time like the Great Depression or Weimar Republic (post WWI Germany), at worst you lose money if economy is stable or even worse the collapse is so bad only food, clothing & weapons have value.

The best advice I have heard is that PM's should only be purchased for emergency preparedness after you have at least 6-12 months of food stored (dried goods like beans, rice, oats in sealed Mylar bags with O2 absorbers), guns (at least a popular semi-auto rifle like an AR or AK in a popular caliber like 223 or 7.62) with spare parts, maintenance/repair tools & ammo (at least 2-5k rounds), medical supplies.

There are other items you could add, but those are the basics that will be good insurance & you can always use them if things don't go south. Make sure your dried food is stuff you & your family will eat so you can cycle through it as it gets old.

- Messages

- 10

- Reactions

- 6

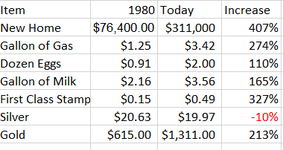

A fine example of silver not being an investment.

But not an argument against PMs as "unsurance".

The time period matters.

1980 was high point in silver prices because of terrible inflation.

"During the Hunt brothers' accumulation of the silver, prices of silver bullion rose from $11 an ounce in September 1979 to $49.45 an ounce in January 1980 based on London PM Fix. Silver prices ultimately fell to below $11 an ounce two months later."

Anyone that bought silver from the mid-60's to 1979 as inflation increased,

was glad to sell and collect on their policy in 1980.

http://www.zerohedge.com/news/2016-04-27/end-venezuela-runs-out-money-print-new-money

But not an argument against PMs as "unsurance".

The time period matters.

1980 was high point in silver prices because of terrible inflation.

"During the Hunt brothers' accumulation of the silver, prices of silver bullion rose from $11 an ounce in September 1979 to $49.45 an ounce in January 1980 based on London PM Fix. Silver prices ultimately fell to below $11 an ounce two months later."

Anyone that bought silver from the mid-60's to 1979 as inflation increased,

was glad to sell and collect on their policy in 1980.

http://www.zerohedge.com/news/2016-04-27/end-venezuela-runs-out-money-print-new-money

Last Edited:

There is a physical pleasure in hefting a large weighty bag of silver ounces.

It might not be the best investment, but the glint of newly minted high polished silver rounds does bring a certain joy in ownership to me at least.

Thirty five years ago, I was befriended by an elderly man that taught me how to hog line fish for salmon in the Columbia River.

He was like a grandfather to me and one day while we were in his garage tying up some fishing tackle, he asked me to lower a Folgers coffee can from a top shelf above his work bench.

When I tried to lift the can that was marked "Galvanized Washers" I could barely slide it off the shelf, let alone heft it upwards.

With a twinkle in his eye he asked me to open it up and packed inside was a can full of gold coins.

I have seen the crown jewels of England, but that can of gold so close to me took only an instant to start a jealous lust inside of me.

It was the primal greed from that gleaming gold that really shocked me, and I now understand why men have killed for it, because after I got over the initial shock, I turned to him and said I wished he hadn't shown it to me, as that was a lot of money to be setting out in an unlocked garage.

He just laughed and said that he trusted me completely. That meant more to me then 10 cans of gold.

It might not be the best investment, but the glint of newly minted high polished silver rounds does bring a certain joy in ownership to me at least.

Thirty five years ago, I was befriended by an elderly man that taught me how to hog line fish for salmon in the Columbia River.

He was like a grandfather to me and one day while we were in his garage tying up some fishing tackle, he asked me to lower a Folgers coffee can from a top shelf above his work bench.

When I tried to lift the can that was marked "Galvanized Washers" I could barely slide it off the shelf, let alone heft it upwards.

With a twinkle in his eye he asked me to open it up and packed inside was a can full of gold coins.

I have seen the crown jewels of England, but that can of gold so close to me took only an instant to start a jealous lust inside of me.

It was the primal greed from that gleaming gold that really shocked me, and I now understand why men have killed for it, because after I got over the initial shock, I turned to him and said I wished he hadn't shown it to me, as that was a lot of money to be setting out in an unlocked garage.

He just laughed and said that he trusted me completely. That meant more to me then 10 cans of gold.

- Messages

- 84

- Reactions

- 94

diversify! everything! a little of this a little of that! Silver is good for storing your fiat dollars. When they are worthless the silver will still have value! As is evidenced by the last few thousand years or so. 90% is best cause of the confidence factor. Lose the credit cards and debt. You can buy a little at a time to store your savings while paying off debt and bills. ANY savings is better than none!

- Messages

- 259

- Reactions

- 465

It's a good time to buy if you have the disposable funds to buy with. Under $20 is fine for stocking up, you average your costs anyway.

If you have enough, stop buying.

If you have enough, stop buying.

- Messages

- 1,208

- Reactions

- 1,380

Not true. The largest fortunes were made by people with debt when inflation hit, and they paid their debt with worthless paper. The problem is timing. The Fed keeps easing and the bubble keeps inflating. Unfortunately we also have a Gold bubble. There is a lot more Gold on paper than the real thing. When the SHTF paper Gold may be worthless. Silver has enjoyed less limelight and as such is a currency if you have coins.Zero debt is better than gold or silver.

Diamond Lifetime

- Messages

- 6,124

- Reactions

- 13,918

That is a dumb chart that has some major issues.

If you just went back 15 years instead of 35 silver would be up 250% (even at today's price which is 50% of what it was just a few years ago) which would eclipse the 15 year gains of most of the other things on the chart. The chart happens to pick the one year in the last 100 that silver was in a bubble.

If you just went back 15 years instead of 35 silver would be up 250% (even at today's price which is 50% of what it was just a few years ago) which would eclipse the 15 year gains of most of the other things on the chart. The chart happens to pick the one year in the last 100 that silver was in a bubble.

- Messages

- 79

- Reactions

- 166

I just invested a couple of grand in 250 gallons of LPG, a tank to store it, a 9K LPG generator and, most expensive a plumber who worked two days digging a ditch and plumbing the whole setup, including an outlet for the genny, one for my bbq, a spare for a fireplace (future if electricity goes out and my heat pump won't work) and our existing kitchen range.

Propane is only $0.96/gallon right now in this area and it doesn't go bad like gas (will) or diesel (can). I'm going to get an extra 100 gallon tank as budget permits.

That being said, I enjoy buying 90% Silver coins and have a variety in my safe. I ignore Gold because it's too hard to buy a dozen eggs with even 1/10 ounce Gold coins in a SHTF world.

I ask myself, "If an EMP knocks out the power grid today, what would I need most?" Well - I have one. Power to pump the water? I got it. Air? Free for me but DW needs an O2 concentrator to live. That needs 12V or 120V. Got both. Food? got about 6 months worth and enough land for a garden, chickens, even a pig or two. Non-inflatable money? Got Silver. Means of reasonable defense? Covered.

Make your own checklist. JMHO

Propane is only $0.96/gallon right now in this area and it doesn't go bad like gas (will) or diesel (can). I'm going to get an extra 100 gallon tank as budget permits.

That being said, I enjoy buying 90% Silver coins and have a variety in my safe. I ignore Gold because it's too hard to buy a dozen eggs with even 1/10 ounce Gold coins in a SHTF world.

I ask myself, "If an EMP knocks out the power grid today, what would I need most?" Well - I have one. Power to pump the water? I got it. Air? Free for me but DW needs an O2 concentrator to live. That needs 12V or 120V. Got both. Food? got about 6 months worth and enough land for a garden, chickens, even a pig or two. Non-inflatable money? Got Silver. Means of reasonable defense? Covered.

Make your own checklist. JMHO

- Messages

- 247

- Reactions

- 289

I just invested a couple of grand in 250 gallons of LPG, a tank to store it, a 9K LPG generator and, most expensive a plumber who worked two days digging a ditch and plumbing the whole setup, including an outlet for the genny, one for my bbq, a spare for a fireplace (future if electricity goes out and my heat pump won't work) and our existing kitchen range.

Propane is only $0.96/gallon right now in this area and it doesn't go bad like gas (will) or diesel (can). I'm going to get an extra 100 gallon tank as budget permits.

That being said, I enjoy buying 90% Silver coins and have a variety in my safe. I ignore Gold because it's too hard to buy a dozen eggs with even 1/10 ounce Gold coins in a SHTF world.

I ask myself, "If an EMP knocks out the power grid today, what would I need most?" Well - I have one. Power to pump the water? I got it. Air? Free for me but DW needs an O2 concentrator to live. That needs 12V or 120V. Got both. Food? got about 6 months worth and enough land for a garden, chickens, even a pig or two. Non-inflatable money? Got Silver. Means of reasonable defense? Covered.

Make your own checklist. JMHO

Depending on the severity and longevity of collapse it may take 1/10th oz gold to buy eggs, or maybe an infinite amount. But then your chosen denomination of PM's will be the least of your worries.

Silver Lifetime

- Messages

- 42,667

- Reactions

- 110,764

Buying precious metals is a bet against fiat currencies.

All fiat currencies eventually go to zero.

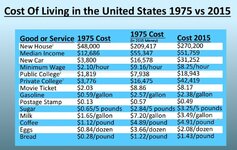

Think about how much value the dollar has lost in the last 40 years.

Uhhhhh....

So let's see here. If you adjust the cost 0f things 40 years ago for increases in income, college and housing and a car are more expensive.

Food, gasoline, etc., about the same or less.

So I don't necessarily agree with your assertion.

- Messages

- 247

- Reactions

- 289

Uhhhhh....

View attachment 290332

So let's see here. If you adjust the cost 0f things 40 years ago for increases in income, college and housing and a car are more expensive.

Food, gasoline, etc., about the same or less.

So I don't necessarily agree with your assertion.

The things that stand out in that chart are homes (+20%), cars (+90%) & education (+100-180%) are all more than they were in 1975 & median income & minimum wage are both less, so that is what takes up the biggest chunk of income. Things like food staples may have been relatively stable or less in cost, but those make a small part of expenditures in cost of living. Housing, utilities & transportation take the majority of income, especially if that income is comparatively less.

Diamond Lifetime

- Messages

- 6,124

- Reactions

- 13,918

All other arguments aside, If you would have bought the first day of this thread you would be up a buck an oz.

Share This Discussion

Similar threads

- Replies

- 26

- Views

- 1K

- Replies

- 66

- Views

- 21K

Upcoming Events

New Classified Ads

-

-

-

-

-

-

-

-

-

-

Ruger 10/22 Takedown 18" Stainless Barrel with Stock

- Started by s75n

- Replies: 0

Support Our Community

If our Supporting Vendors don't have what you're looking for, use these links before making a purchase and we will receive a small percentage of the sale