- Messages

- 6,244

- Reactions

- 7,103

Australia Stops "Cooking" Its Jobs Report And The Result Is A Disaster: Full-Time Jobs Plunge Most Since 2013

Submitted by Tyler Durden on 02/17/2016 20:20 -0500

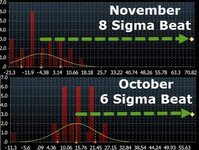

One week ago, we were delighted to report that Australia admitted that its glorious, 6 and 8-sigma outlier job numbers from October and November, were nothing but a "technical issue" glitch, in other words, one big political lie.

Specifically it was Treasury Secretary John Fraser, who admitted during testimony to parliamentary committee that jobs growth for the two months in question "may be overstated." What's the reason? The same one the propaganda bureau always uses when its lies are exposed: "technical issues",

There were some "technical issues" in October and November that may have made the employment figures "look a little bit better than otherwise would be the case," he said. The technical issues relate to "rolling off" of participants in the labor survey.

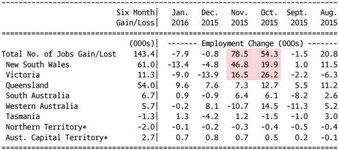

Australia's economy added 55,000 jobs in October and a further 74,900 in November, before shedding 1,000 in December to produce the record quarterly gain. Questions regarding the accuracy of the data have been raised following acknowledgment by the statistics agency in 2014 of measurement challenges.

In conclusion we asked "why the sudden admission it was all a lie? Simple: weakness in commodity prices "is far greater than people had been expecting," Fraser said in earlier remarks to the panel. Australia is now "swimming against the tide" because of uncertainties in the global economy, he added."

What this really meant, as we translated, is that: "we need more easing, and to do that, the economy has to go from strong to crap." And with the Australian economy suddenly desperate for lower rates from the RBA, one can ignore the propaganda lies, and focus once again on the far uglier truth.

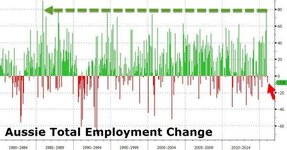

That "far uglier truth" was revealed moments ago, when not only was the "jobs miracle" of October and November buried for good...

... but suddenly - as we predicted - the far uglier truth finally emerged, when Australia reported that not only did total jobs tumble by 7,900, far below the +13,000 forecast (down from the December's 800 job decline)...

... but the actual number of full-time jobs plunged by 40,600, the biggest monthly plunge since October 2013!

The end result a sudden, and unexpected bounce in the unemployment rate from 5.80% to 6.00%, some 20 basis point above the consensus estimate.

And judging by the corresponding tumble in the AUDUSD, suddenly the realization that the RBA - no longer able to delay reality - will be the next bank to ease as the Chinese deflationary tsunami proves to strong for anyone to resist.

http://www.zerohedge.com/news/2016-0...jobs-plunge-mo

Submitted by Tyler Durden on 02/17/2016 20:20 -0500

One week ago, we were delighted to report that Australia admitted that its glorious, 6 and 8-sigma outlier job numbers from October and November, were nothing but a "technical issue" glitch, in other words, one big political lie.

Specifically it was Treasury Secretary John Fraser, who admitted during testimony to parliamentary committee that jobs growth for the two months in question "may be overstated." What's the reason? The same one the propaganda bureau always uses when its lies are exposed: "technical issues",

There were some "technical issues" in October and November that may have made the employment figures "look a little bit better than otherwise would be the case," he said. The technical issues relate to "rolling off" of participants in the labor survey.

Australia's economy added 55,000 jobs in October and a further 74,900 in November, before shedding 1,000 in December to produce the record quarterly gain. Questions regarding the accuracy of the data have been raised following acknowledgment by the statistics agency in 2014 of measurement challenges.

In conclusion we asked "why the sudden admission it was all a lie? Simple: weakness in commodity prices "is far greater than people had been expecting," Fraser said in earlier remarks to the panel. Australia is now "swimming against the tide" because of uncertainties in the global economy, he added."

What this really meant, as we translated, is that: "we need more easing, and to do that, the economy has to go from strong to crap." And with the Australian economy suddenly desperate for lower rates from the RBA, one can ignore the propaganda lies, and focus once again on the far uglier truth.

That "far uglier truth" was revealed moments ago, when not only was the "jobs miracle" of October and November buried for good...

... but suddenly - as we predicted - the far uglier truth finally emerged, when Australia reported that not only did total jobs tumble by 7,900, far below the +13,000 forecast (down from the December's 800 job decline)...

... but the actual number of full-time jobs plunged by 40,600, the biggest monthly plunge since October 2013!

The end result a sudden, and unexpected bounce in the unemployment rate from 5.80% to 6.00%, some 20 basis point above the consensus estimate.

And judging by the corresponding tumble in the AUDUSD, suddenly the realization that the RBA - no longer able to delay reality - will be the next bank to ease as the Chinese deflationary tsunami proves to strong for anyone to resist.

http://www.zerohedge.com/news/2016-0...jobs-plunge-mo